"The quarterly reports are highlighting a microeconomic picture that despite a high level of inflation and a drop in growth estimates globally still shows resilience," says Corrado Cominotto, head of Active Asset Management at Banca Generali. "However, over the course of the next few months it will be necessary to assess whether the increase in corporate margins due to higher inflation will be supported by a resilience in consumption. We believe for this reason that we will see phases of volatility on the main stock markets."

Turning to a full-year analysis, at the end of 2023 earnings are expected to grow compared to 2022, by 0.6 percent distributed between +1.9 percent for the Eurozone and +0.4 percent for the United States. Experts expect above-average earnings growth for the financial and consumer durables sectors (+15 percent) while below average for the energy and commodities sectors.

Europe boasts lower multiples than the US and in particular trades at 12.5 times expected earnings. Italy continues to be one of the most discounted markets with an expected price-earnings ratio of 8.30.

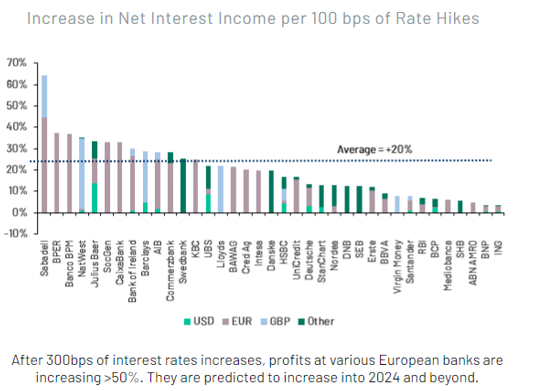

As for the banking sector, the crises of some U.S. banks (from Svb to Signature Bank) and European banks (see the Credit Suisse cases) have not dented earnings in the sector. The winds of recession shaking European markets do not seem likely to jeopardize a year that many observers and analysts believe will be even better than that of 2022, thanks in part to the rate hike that drove the interest margin in the year just ended-a trend that continued with vigor in 2023.

In fact, the boost to profitability is mainly due to a monetary policy measure: the ECB's rate hike, which continued by about 100 basis points between January and March and today saw a new quarter-percentage point rise bringing the main refinancing rate to 3.75 percent, the deposit rate to 3.25 percent, and the marginal lending rate to 4 percent. "We are not taking a break from raising rates, we know we still have a way to go," said ECB President Christine Lagarde. "The banking sector has proven resilient but significant upside risks remain on the inflation outlook" and the war in Ukraine "could again raise energy and food costs."

In contrast, the end of the Fed's rate hike is near, which yesterday after an additional 0.25 percent basis point increase yesterday for the first time did not hint at new hikes. Such normalization will tend to have an echo on the interest margin of star banks, which will have to find a new boost to sustain profitability.

Corrado Cominotto, responsabile Gestioni Patrimoniali attive di Banca Generali

Corrado Cominotto, responsabile Gestioni Patrimoniali attive di Banca Generali