What is Deflation?

Deflation consists of a decrease in the general price level and is the exact opposite of the much better known and demonized inflation.

The term deflation means a decline in the general price level. Thus, deflation is the opposite of the much known inflation, that is, the process of gradual increase in prices.

In many cases there is only a slowdown in inflation, that is, a decrease in the rate of growth of the general price level-this is a third phenomenon that is called disinflation.

Deflation proper is generally a negative phenomenon, but there are "positive" types of deflation and favorable aspects of it.

What are the consequences of deflation

A decline in the general price level most often results from a recessionary (i.e., negative growth) situation in which the demand for goods and services-so-called aggregate demand-contracts. Spending by people and companies, in other words, shrinks. This prompts companies themselves to try to sell their products at lower prices, hoping to stimulate demand and a consumer response.

The result is that companies sell their products at a lower price and thus experience a decrease in sales. To offset this contraction in turnover characteristic of economies in a state of deflation, firms try to reduce costs for raw materials and services derived from other firms, cut labor costs, and squeeze financing from banks (by reducing borrowing costs on debts incurred).

These interventions, in turn, tend to compress aggregate demand for goods and services, aggravating the situation and bringing new deflationary pressures. The growth in unemployment resulting from cutting labor costs, for example, will force the newly unemployed to reduce their spending, negatively affecting demand.

Deflation, however, also tends to be matched by an increase in savings, which can lay the groundwork for a healthy economic recovery.

The risks of deflation: the case of Japan

Mentioned often in textbooks is the case of Japan's "Lost Decade."

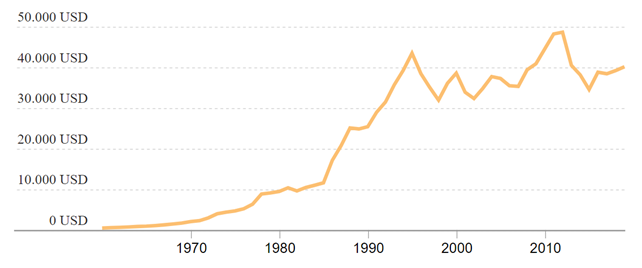

Between the early 1990s and the early 2000s, Japan's gross domestic product growth came to a halt, getting stuck on a +1.2 percent per year, which was lower than the growth rates of other advanced economies.

This was due to the bursting of a real estate and financial speculative bubble that collapsed domestic demand, a situation in which the monetary policy choices implemented by the Central Bank did nothing to stem the damage, leaving room for a challenging environment that threatened the Japanese economy.

To this day, Japan still has a particularly high debt-to-GDP ratio, and analysts over the years have pointed to more structural aspects induced by the deflationary drive that have led the country to see an aging population, a shift from central to local government, the sharp growth of impaired loans on bank balance sheets, and the strong appreciation of the yen in previous years.

Japanese GDP - Data Commons source

Are you interested?

Leave your info here to find out more and be contacted by one of our financial advisors!

Thank you, you will be contacted as soon as possible

Thank you, you will be contacted as soon as possible

Error while saving data, try again later